Want to know more?

Are you interested in this project? Or do you have one just like it? Get in touch. We’d love to tell you more about it.

As the Middle East’s leading provider, with annual turnover of around $350 million, our client offers a wide range of payment services. From card issuing and merchant acquisition to payment processing and provision of in-store, online and mobile payment solutions—across multiple international markets—they manage sophisticated end-to-end payment journeys. And, they do it for all types of clients; from large enterprise and government organisations to small-medium retail businesses and micro-merchants.

The lynchpin for many of these services is an event-driven payments platform that Equal Experts helped to build from the ground up. The platform provides merchants with a single point of contact to initiate, process, capture and track a variety of payments spanning credit card, bank transaction, PayPal, China UnionPay, M-Pesa and more. Learn how the payment platform uses event driven architecture to provide secure, fast and reliable payments, protect against fraudulent payments, and offer a seamless experience for both merchants and customers alike.

This case study will help you to understand:

Our client is a major provider of online payment solutions to merchants and financial institutions in the Middle East – with an annual turnover of c.$350m.

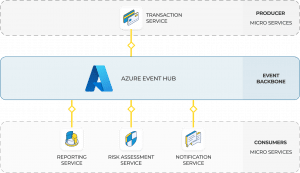

The digital payment platform is built using microservices and leverages event-driven patterns for real-time automation and insights into payment processing.

While the payment platform consists of more than 25 microservices in totality, this case study will focus on a subset of core services to highlight the value of event-driven processes that occur within the platform.

These include the:

Whenever an order or payment is processed in the transaction service, it sends out a variety of events (which can be thought of as ‘triggers’ containing data for subsequent, automated processes) to the event backbone, Azure Event Hub. The event backbone, in turn, fires events to services which are configured to ‘listen’ to them. These listening services are configured to consume specific events related to their core business function; it’s a ‘pull’-style configuration, rather than the ‘pushing’ of data packets.

Learn more about ‘receiver-driven routing’ in events

For example, if the transaction service processes 50 payments from one personal account number (PAN) in 10 minutes, an event is produced to notify the risk assessment service to take action to prevent the fraud (see section 03. ‘Using events for real-time fraud detection’). The reporting service may ‘listen’ for the same event, and provide an update that a certain payment or account is potentially compromised.

Examples of event-driven processes include:

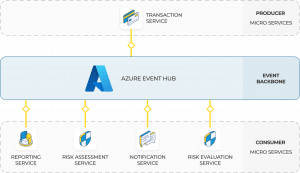

In addition to automating processes, improving real-time insight, and enhancing the resilience of systems, event driven architectures are infinitely—and easily—extensible.

For example, imagine a scenario where the above process requires the introduction of a gateway risk evaluation. Events are already being generated and fed into the event backbone; another event consumer (the risk evaluation service) can be configured to ‘listen for’ and consume that same stream of events for an entirely independent business requirement.

Picture the scenario: you run an online retail store, selling high value homewares like televisions, watches and cosmetics

A customer visits your eCommerce store and orders a TV. By submitting their card details, a series of events are immediately triggered to start validating the payment.

On payment capture, a series of events are triggered to automate notifications to both you and your customer.

While the notifications are being prepared and sent—which only takes a couple of seconds—all of your reporting is updated in real-time with detailed information highlighting the nature of the payment. You receive a notification, and you can view the information in your self-service portal.

Critically, the varying steps in these payment validation processes can occur asynchronously in event-driven architectures.

Structuring the payment process as a series of decoupled, independent mircoservices creates two crucial benefits;

Firstly, the various, complex steps involved in validating payments can occur in a non-linear way. This makes things faster overall, especially when compared with traditional sequential or synchronous processing.

By their nature, event-driven architectures are ‘fire and forget’. In other words, there’s no compulsory requirement for a microservice to wait for a response before initiating the next step in a sequence.

For example, the transaction service might receive a payment, fire an event to the reporting service to create a log of that payment being received, and begin the process of validating that payment. This process can occur entirely independent of the reporting service acknowledging to the transaction service that a log has been created and saved in the reporting database.

These efficiencies may seem small in isolation, but at scale—when large enterprises or national retailers are processing tens or hundreds of thousands of payments per hour—the impact for processing and customer experience can be huge.

For example, the transaction service might receive a payment, fire an event to the reporting service to create a log of that payment being received, and begin the process of validating that payment. This process can occur entirely independent of the reporting service acknowledging to the transaction service that a log has been created and saved in the reporting database.

In addition to speed, asynchronous processing and event driven architectures break the chains of interdependencies commonly seen in synchronous structures like REST or gRPC. This drastically reduces the risk of service degradation cascading across multiple microservices.

Synchronous processing: In synchronous or linear processing, responses times can grow as requests are pushed downstream through a chain of increasingly overwhelmed services.

Event-driven processing: In contrast, event-driven processing is ‘receiver-driven’. Each microservice pulls from the queue as it is capable of processing requests, meaning many services function together to make light work of high volume periods.

In addition to speed and reliability, event-driven processing allows the payment platform to screen for fraudulent transactions much faster, and even pre-empt and block those transactions before they can occur.

In most card-based frauds, stolen cards are used to make multiple, rapid transactions through different channels in quick succession. For example, a person might quickly attempt a transaction on ten different devices in five minutes using a stolen card.

Using events, the platform tracks attempted transactions against specific primary account numbers (PANs) and triggers an event for each transaction. Those events are recorded against a sliding window of time. If a specific PAN exceeds the acceptable transaction threshold within a certain time window—for example, 25 transaction attempts within a 30-minute period—another event is triggered and consumed by a fraud-risk engine for analysis. The risk engine, in turn, flags potentially fraudulent transactions in real time, and the proposed payment(s) will be prevented from progressing towards validation.

Events are also useful for version-control style functionality and sustained visibility of merchant-customer activity.

Whenever sensitive risk rules are modified by merchants using the self-service platform—for example, they decide to block certain countries or increase their online transaction limits—the configuration service creates an event which is consumed by the notification service. The notification service triggers an event to the fraud management team to ensure full, real time visibility of any changes to the risk rules, and a more detailed, to-the-minute profile of each customers’ unique context.

While event driven architectures are enormously beneficial for internal processing and operations, they offer crucial benefits in general end user experience too – merchants get their money faster than ever before.

Payment platforms are incredibly high throughput applications. Additionally—as a leading provider of payment solutions—our client integrates with a huge number of merchants to serve customers around the world.

By decoupling microservices and using asynchronous processing (see section 02. ‘The benefits of asynchronous processing in payment gateways’), we can provide high speed transaction rates which are simply not possible using synchronous blocking or sequential processing. The result? Merchants get revenue delivered to their acquisition accounts faster than before, and customers get their orders processed and confirmed at lightning pace.

Merchants can access a self-service portal which offers:

By their nature, event-driven architectures are inherently extensible and provide a range of benefits for integration. For example, events can mitigate instances of ‘domain bleeding’ by reconfiguring data in whichever way any third-party interfaces might require. This is particularly useful in a payment platform, digital banking platform, or any other type of complex system that requires multiple integrations.

Additionally, the payment platform’s microservice applications use a Hexagon architecture pattern that follows the domain-driven design philosophy. This provides the flexibility to change or update the technology stack without modifying domains or business rule implementations.

Tools and system integrations used:

Are you interested in this project? Or do you have one just like it? Get in touch. We’d love to tell you more about it.