Want to know more?

Are you interested in this project? Or do you have one just like it? Get in touch. We’d love to tell you more about it.

ListSure is an Australian-based financial services representative of The Hollard Insurance Company, a global insurer with businesses in Africa, Europe, India, China, Australia, and New Zealand.

ListSure offers a unique insurance tool for real estate agents and property vendors. Through a bespoke platform, ListSure provides finances to cover the costs of marketing residential homes for sale: think drone footage, interactive floor plans, and video walk-throughs to highlight key selling features. The thinking? With more compelling listings and better marketing for homes, vendors will achieve more sales, typically at higher price points. Beyond marketing, there are also plans to use the platform for a broader suite of real estate activities, including financing for interior design through ‘pay on success’, conveyancing services and more.

With ListSure enjoying rapid growth, the increase in scale and frequency of their opportunities required a change in approach. New technologies would support the team to work more efficiently, deliver more value, and accelerate their growth even further. Here’s how we guided ListSure through a transformation process, adopting new technologies and delivery methods to deliver far more value—far more frequently—without losing continuity of service.

day release cycles – down from 9 months

connections with previously unidentified market segments

of choice due to the success of our initial partnership

ListSure is a fintech innovator operating within the real estate industry, with a focus on delivering unique products and initiatives to better serve the sector. It is an Australian-based financial services representative of The Hollard Insurance Company, a global insurer with businesses in Africa, Europe, India, China, Australia, and New Zealand. ListSure was initially founded by melding two financial products—finance and insurance—to create ‘Pay on Success’. Today, the team is working to develop and deliver a wider suite of financial tools and products to create value for the real estate sector.

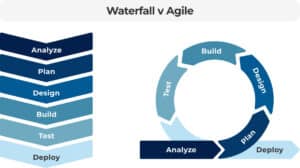

Prior to our partnership, ListSure had been working with an incumbent consultancy firm and operating with a traditional waterfall delivery approach. Unfortunately, the waterfall delivery methodology was no longer reflective of the team’s—nor the platform’s—requirements.

For ListSure to grow, release cycles needed to be much faster and more frequent. The team needed support to adopt a process of continuous delivery and a DevOps pipeline to enable continuous integration

Beyond the move towards continuous delivery, we also encouraged the shift from ‘project thinking’ to product thinking. This meant:

Through a series of initial diagnostics, we quickly identified a number of simple improvements to help streamline ListSure’s user experience. We intentionally started with smaller self-contained suites of work, like de-bugging existing assets and gradual reappraisal of functionalities.

By starting small—through bug-fixing work and smaller-scale feature deployment—we encouraged the ListSure team to adopt change iteratively.

Now that the team is comfortable with new, proven technologies and processes, we’re collaborating to re-write and improve ListSure’s core internal workflows.

Rather than take a top-down approach—and simply introduce a variety of new frameworks without any ‘on-the-tools’ support—we coached the ListSure team to collaboratively adopt more agile work practices.

Feedback formed a critical part of the process from start to finish, with the coaching approach tailored based on feedback received throughout. This way, we encouraged the adoption of proven frameworks in the ways that are most meaningful for the ListSure team. Where possible, we adapted workshops and deliverables to create maximum value by reflecting ListSure’s unique organisational context and culture.

By leveraging the Equal Experts network of over 1,000 highly experienced specialists, we drew on a world-class pool of expertise.

This approach ensured we called on the right experts for ListSure’s unique requirements throughout the project—rather than simply drawing on available local resources—while delivering without any disruption caused by the COVID-19 pandemic.

Thanks to the success of our initial partnership, we are now ListSure’s technology partner of choice.

Equal Experts provided ListSure with a competitive edge by bringing global expertise to local business problems. Equal Experts have a spirit of partnership in their DNA and deeply understand my business, my people, and my clients.

Are you interested in this project? Or do you have one just like it? Get in touch. We’d love to tell you more about it.